미국의 대부분의 교회가 기업인 이유

미국의 대부분의 교회가 기업인 이유

대런 시어러 발행

어렵고 어색한 사실입니다. 우리 대부분이 일요일 아침에 참석하는 교회는 사업체입니다.

나는 이것이 우리가 인정하기 어렵다는 것을 알고 있습니다. (이 기사의 끝 부분에서 이러한 편견 중 일부를 다룰 것입니다.)

미국의 종교는 1조 2천억 달러 규모의 산업이지만 교회와 다른 종교 기관이 많은 돈을 벌어들이기 때문에 이 주장을 하는 것이 아닙니다. 교회는 기업으로 간주되기 위한 더 많은 기준을 충족합니다.

(이 기사에서 나의 목표는 우리 교회의 대부분이 기업체라는 것이 좋은지 나쁜지에 대한 결론을 내리는 것을 자제하는 것입니다. 사업주로서 저는 비즈니스가 기독교 사역을 위한 이상적인 장소라고 생각합니다. 그러나, 나는 사업을 운영하고 주주들에게 그것이 사업보다 더 고귀하고 영적인 것이라고 확신시키려고 시도하는 것은 정직하지 않다고 생각합니다.)

1 – 교회는 사람들이 시장에서 돈을 지불하는 것과 동일한 서비스를 제공합니다.

사람들은 훌륭한 음악과 훌륭한 대중 연설을 경험하기 위해 수십억 달러를 지불합니다. 이것은 사람들이 일요일 아침 예배에 참석할 때 추구하는 두 가지 주요 사항입니다.

예를 들어, 저는 얼마 전에 경이로운 Chris Tomlin 음악 콘서트에 갔는데, 그 음악은 매주 일요일 전 세계 교회의 음악 그룹에서 연주/취재됩니다.

이번 콘서트에서 Louie Giglio 목사는 하나님의 사랑에 대한 강력한 메시지를 전했습니다. 전체 경험은 잊을 수 없는, 많은 교회들이 매주 일요일 아침을 위해 노력하는 그리스도 중심의 하나님의 움직임의 유형이었습니다.

아내와 내가 이 경험을 하기 위해 티켓 가격은 각각 25달러였습니다.

1인당 25달러의 입장료를 받는 교회를 상상할 수 있습니까? 이것이 왜 그렇게 억지처럼 보입니까?

저는 최근 중소/평균 규모의 교회에 보조금을 제공하는 재단에서 평균 규모의 609개 교회에 대한 수입 및 지출 데이터를 추적했습니다. (참고: 약 85%의 교회는 매주 200명 이상으로 성장하지 않습니다.) 다음은 이 재단이 저에게 보낸 데이터에 대한 평가를 바탕으로 제가 발견한 몇 가지 샘플입니다.

매주 평균 162명이 참석하는 교회에서 한 명의 참석자를 호스트하는 비용 = 1인당 $23.80(어린이에게도 동일한 요금 적용)

주당 평균 100명 이상의 추가 참석자(주당 참석자 268명)가 조금 넘는 교회의 경우 규모의 경제로 인해 교회 비용이 1인당 16%(1인당 $20.02) 감소했습니다. 매주 1000명 이상의 참석자가 있는 대형 교회에 대한 데이터는 없지만, 이러한 추세가 계속된다면 교회에서 매주 100명 이상의 참석자를 추가할 때마다 실제 1인당 비용이 계속해서 크게 떨어질 것으로 예상됩니다.

매주 평균 162명이 참석하는 교회의 연간 헌금 = $217,170

참고: 미국에는 약 300,000개의 개신교 교회가 있습니다. 매주 162명의 참석자가 대략 미국의 모든 개신교 교회의 평균 규모라는 점을 감안할 때 이는 미국의 개신교 교회가 연간 약 399억 달러의 수입을 거두고 있음을 의미합니다. 이는 300억 달러로 추산되는 미국 전체 헬스클럽 산업 규모보다 100억 달러 더 많은 금액이다.

매주 평균 162명이 참석하는 교회의 목회자 급여(주거, 사례비 등과 같은 기타 부가 혜택 제외) = $38,957

일반적인 일요일 아침에 162명이 출석하는 교회에 참석한다고 가정해 보겠습니다(부활절 일요일에 대해 말하는 것이 아닙니다). 귀하의 교회 참석 비용은 $23.80입니다. 4인 가족의 경우 비용은 $95.20입니다.

분명히, 교회에 참석하는 대부분의 사람들은 헌금을 통해 자신의 가족이 참석하는 데 드는 비용을 충당하지 않습니다. 이는 소수의 참석자가 참석자 대다수의 비용을 부담하고 있음을 의미합니다. 저는 교회 기업가/CEO가 이 재정적 합의의 현실에 대해 모든 사람에게 정보에 입각한 동의를 제공하는 한 이 합의가 괜찮다고 생각합니다.

단순히 재정적인 여유가 없는 한, 모든 정규 교회 참석자는 귀하가 귀하의 교회 재정 부서에서 이 정보를 얻을 수 있다고 가정하고(어려울 수 있음) 매주 귀하의 교회에 대한 실제 1인당 비용을 제공해야 한다고 생각합니다. 저는 교회가 이 정보를 공개해야 한다고 생각합니다.

이제 “우리는 경험에서 그 정도의 가치를 얻지 못하기 때문에 가족이 참석하기 위해 일요일마다 1인당 $23.80를 지불할 방법이 없습니다”라고 말하는 경우 다른 교회를 찾거나 다른 교회를 찾는 것이 좋습니다. 정기적으로 동료 신자들과 함께 예배를 드리는 보다 비용 효율적인 방법(예: 예배를 위해 집에서 그리스도인 친구들과 모임, 비용이 적게 드는 교회에 참석, 일인당 비용이 더 낮은 더 큰 교회에 참석) , 등.).

2 – 교회는 법인입니다.

이 기사에서 내가 “교회”라고 말할 때, 나는 보편적인 “교회”, 즉 예수 그리스도를 그들의 주와 구세주로 고백하고 그들의 죄를 회개한 전 세계 하나님의 백성의 총합(즉,

e “그리스도의 신부”).

특정 주소(일반적으로 다른 교회에서 몇 마일 이내)에 위치한 법인인 “교회 주식회사”에 대해 이야기하고 있습니다. 이 법인은 일반적으로 일요일 아침에 리허설된 음악과 재정적으로 전달되는 연설을 포함하는 모임을 주최합니다. 보상을 받는 공개 연사로, 일반적으로 참석자로부터 요청받은 금액을 모금합니다.

저는 이러한 교회 기관 중 하나에 참여하고 있으며 좋은 기관 중 하나입니다.

나는 또한 내가 일요일 아침에 참석하는 교회를 사업으로 생각할 것입니다. 그것은 우리 지역 사회에 가치를 제공하고, 국법을 준수하려고 노력하고, 지역 사회를 위한 일자리를 창출하고, 더 많은 사람들에게 혜택을 주는 이윤을 창출하고, 예수 그리스도의 제자를 만드는 것을 목표로 합니다. 작동하다.

3 – 교회는 이익을 창출합니다.

교회가 매주 참석자당 수입이 $23.80에 도달하면 헌금을 중단합니까? 당연히 아니지. 왜? 그들은 가능한 한 수익성이 있기를 원하기 때문입니다.

병원, 대학, 소매점, 투자 은행 등과 같이 교회는 이익을 창출합니다. 교회가 계속 운영된다면 이익이 있음을 확신할 수 있습니다. 수익이 떨어지면 문을 닫습니다.

그러나 우리 대부분이 일요일 아침에 출석하는 지역 교회와 사회에서 대위임령을 수행하는 다른 그리스도 중심 사업(예: 그리스도 중심 건설 회사, 그리스도 중심 패스트 푸드 레스토랑 등) 사이의 주요 차이점은 다음과 같습니다. 조직의 리더는 이익을 자신의 주머니에 넣는 것이 법적으로 금지되어 있습니다. 이것이 미국에서 501c3 면세 조직이 된다는 것이 의미하는 바입니다.

(아마도 법에 저촉되지 않는다면 적어도 수익의 일부는 챙겼을 것입니다. 결국 그들 중 많은 사람들이 교회를 설립한 기업가들이기 때문에 기업가가 다른 건물을 짓는 데 들인 노력만큼의 노력이 필요했습니다. 비슷한 규모의 중소기업)

그러나 이익은 여전히 존재합니다. 그것은 단지 다른 방식으로 할당될 뿐입니다(예: 새 건물, 당신의 목사가 자신의 교회에 와서 설교하게 함으로써 호의를 보답하는 유료 초청 설교자, “전략적 사역 파트너”에게 주는 것 등).

목회자의 여행 경비를 충당하기 위해 이익이 자주 할당됩니다. 예를 들어, 나는 우리 도시에 있는 한 대형교회 목사를 알고 있는데 그는 그곳의 파트너 교회에서 설교하기 위해 매주 아프리카를 여행합니다. 항공료만 해도 연간 최소 $70,000입니다.

재정적인 어려움에 처한 교인에게 자선을 베푸는 경우, 신청자의 기부 이력이 부분적으로 고려되어 그 사람이 과거에 예치하지 않은 자금을 인출하지 않도록 합니다.

이것은 비즈니스에 대한 논리적 접근 방식처럼 보입니다. 단지 더워서 헬스클럽에서 수영장에 몸을 담그는 것을 허용할 것이라고는 생각하지 않습니다. 그들은 내가 회비를 먼저 지불했는지 확인하기 위해 먼저 기록을 확인했습니다.

돈을 인출하는 사람들과 다른 회원 혜택이 입금되지 않으면 수익성을 유지하기 어렵습니다.

4 – 교회는 지역 경제를 위한 일자리를 창출합니다

Why Most Churches in the U.S. Are Businesses

Published by Darren Shearer

It’s a hard, awkward truth: The churches most of us attend on Sunday mornings are businesses.

I realize this is difficult for us to admit. (I’ll address some of these biases toward the end of this article.)

Although religion in the United States is a $1.2 trillion dollar industry, I’m not making this case just because churches and other religious institutions bring in a lot of money. Churches meet many more criteria for being considered businesses.

(In this article, my goal is to refrain from drawing conclusions about whether it’s a good or a bad thing that most of our churches are businesses. As a business owner, I happen to believe business is an ideal place for Christian ministry. However, I do believe it’s disingenuous to operate a business and attempt to convince its stakeholders that it’s something somehow more noble and spiritual than a business.)

1 – Churches offer the same services people pay money for in the marketplace.

People pay billions of dollars to experience great music and great public speaking, which are two primary things people are pursuing when they attend a worship service on Sunday morning.

For example, I went to a phenomenal Chris Tomlin music concert not too long ago, whose music is played/covered by music groups in churches all over the world every Sunday.

At this concert, Pastor Louie Giglio preached a powerful message about God’s love. The entire experience was the type of unforgettable, Christ-centered move of God many churches strive for every Sunday morning.

For my wife and I to have this experience, the ticket price was $25 each.

Can you imagine a church charging $25 per person for admission? Why does this seem so far-fetched?

I recently tracked down revenue and expenses data for 609 average-sized churches from a foundation that provides grant funding to small/average-sized churches. (Note: Approximately 85% of churches never grow beyond 200 weekly attendees.) Here are just a few samples of my findings based on my assessment of the data this foundation sent to me:

- Cost to host one attendee for a church averaging 162 weekly attendees = $23.80 per person (same rate applies for children)

- For churches averaging a little more than 100 extra attendees per week (268 weekly attendees), the church’s cost dropped by 16% per person ($20.02 per person) due to economies of scale. Although I don’t have data on megachurches with 1000+ weekly attendees, I would expect the actual per-person cost to continue dropping significantly each time the church adds 100 more weekly attendees if this trend continues.

- Annual collections for churches averaging 162 weekly attendees = $217,170

- Note: There are approximately 300,000 Protestant churches in the United States. Given that 162 weekly attendees is roughly the average size of all Protestant churches in the U.S., this means Protestant churches in the U.S. collect approximately $39.9 billion in revenue annually. This is $10 billion larger than the entire health club industry in the U.S., which is estimated at $30 billion.

- Pastor’s salary for churches averaging 162 weekly attendees (not including any other fringe benefits like housing, honorariums, etc.) = $38,957

Let’s assume you attend a church where 162 people will show up on a typical Sunday morning (I’m not talking about Easter Sunday). Your church’s cost for you to attend is $23.80. If you have a family of four, your cost would be $95.20.

Clearly, most people attending church aren’t covering their own family’s costs to attend through what they give in the offering. This means a small percentage of the attendees are footing the bill for the majority of the attendees. I think this arrangement is fine as long as the church entrepreneurs/CEOs are giving everyone informed consent about the reality of this financial arrangement.

Unless they simply don’t have the financial wherewithal, I believe every regular church attendee should give the actual per-person cost for your church weekly, assuming you can get this information from your church’s finance department (which may be difficult). I believe churches should publicize this information.

Now, if you’re saying, “There’s no way I’m paying $23.80 per person every Sunday for my family to attend because we don’t get that amount of value out of the experience”, I suggest finding a different church or finding a more cost-effective way to worship with your fellow believers on a regular basis (e.g., gathering with Christian friends in a home for worship, attending a church that keeps is costs lower, attending a larger church where the per-person cost is lower, etc.).

2 – Churches are legal entities.

When I say “church” in this article, I’m not talking about the universal “Church”, the sum total of God’s people around the world who confess Jesus Christ as their Lord and Savior and have repented of their sins (i.e., the “Bride of Christ”).

I’m talking about “church, Inc.”, legal entities located at a particular address (usually located within a few miles of another church), that typically host a gathering on Sunday mornings that includes rehearsed music and a speech delivered by a financially compensated public speaker, during which there is usually a collection of money requested from the attendees.

I am involved in one of these church institutions, and it’s one of the good ones.

I would also consider the church I attend on Sunday morning to be a business. It provides value to our community, seeks to obey the laws of the land, creates jobs for the local community, generates profit to benefit more people, and aims to make disciples of Jesus Christ … just like the Christ-centered businesses many of God’s people operate.

3 – Churches generate profit.

When churches reach the requisite $23.80 in revenue per attendee each week, do they stop taking offerings? Of course not. Why? Because they want to become as profitable as possible.

Yes–like hospitals, universities, retail stores, investment banks, etc.–churches generate profit. If the church remains operational, you can be sure there’s profit. When they run out of profit, they close the doors.

But a primary difference between the local churches most of us attend on Sunday mornings and the other Christ-centered businesses carrying out the Great Commission in society (e.g., Christ-centered construction companies, Christ-centered fast food restaurants, etc.) is that the organization’s leaders are legally prohibited from putting the profits in their own pockets. That’s what it means to be a 501c3 tax-exempt organization here in the United States.

(Perhaps they would pocket at least some of the profits if it weren’t against the law. After all, many of them are the entrepreneurs who founded the church, which required just as much effort as it took for an entrepreneur to build any other small business of similar size.)

But the profit is still there. It’s just allocated in different ways (e.g., new buildings, paying guest preachers who will often return the favor by having your pastor come preach at his church, giving to “strategic ministry partners”, etc.).

Profit is frequently allocated to cover the pastor’s travel expenses. For example, I know one megachurch pastor in my city who travels to Africa every single week to preach in partner churches there. That’s at least $70,000 per year just for airfare.

If there is benevolence giving to a member of the church in financial need, the applicant’s giving history will typically be taken into account, partially to ensure the person is not withdrawing from funds he/she has not deposited in the past.

This seems like a logical approach for a business. I wouldn’t expect a health club to allow me to take a dip in their pool just because I’m feeling hot. They would first check their records to see if I had first paid my dues.

It’s hard to stay profitable if the people withdrawing money and other member benefits haven’t been making any deposits.

4 – Churches create jobs for local economies.

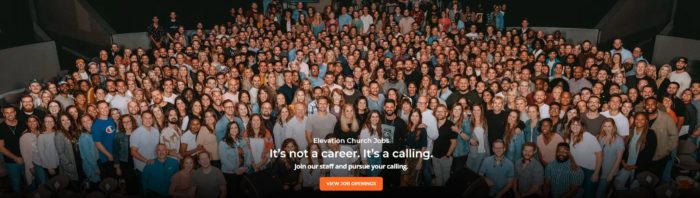

How many people can you count in the picture above? These are all people employed by one single church. This image above demonstrates the economic power of one megachurch in Charlotte, North Carolina to create jobs within its community.

Because there are so many church job openings to fill, there are dozens of employment agencies that specialize solely in recruiting staff members for churches.

5 – Churches use tax loopholes to maximize profits.

Wise entrepreneurs take advantage of every tax loophole to avoid paying any more taxes than are absolutely required.

It just so happens that churches typically have the most lucrative tax classification possible: complete tax exemption. They pay zero taxes on any revenue they bring in.

6 – Churches are strategic about generating revenue.

I believe the main reason churches don’t charge admission–or make more forceful appeals for money–is to avoid deterring visitors, who are the prospective members and givers who will ultimately contribute extra funds to help grow the church. It’s a “taste and see” approach.

Again, this makes good business sense. A health club typically wouldn’t charge a prospective member for the first workout in its facilities.

Likewise, many churches mention to first-time guests that they shouldn’t feel obligated to give during that initial visit. But for everyone else at offering time, it’s time to open those wallets and pocketbooks (or text to give, give through the church app, setup automatic billing through the church website, etc.).

In addition to courting visitors with the hope of them becoming new donors, church entrepreneurs also launch full-spectrum financial giving campaigns periodically throughout the year … especially when the church is building new facilities. These campaigns often involve money collections separate from and in addition to the standard money collection during the Sunday service plus a series of sermons on the theme of giving and/or supporting the leader’s vision (e.g. citing Bible passages such as Nehemiah’s rebuilding of the walls of Jerusalem, Solomon’s building and dedication of the temple, etc.).

In his book, The Coming Revolution in Church Economics: Why Tithes and Offerings Are No Longer Enough and What You Can Do About It, Pastor Mark DeYmaz suggests that his fellow pastors should start exploring new opportunities for generating revenue beyond weekly donations, pursuing multiple streams of income. Some of his suggestions include…

- Stop giving out free coffee and donuts, and start charging for them.

- Rent out church facilities when/where not in use.

7 – Churches compete.

Many churches require new pastoral staff members to sign non-compete clauses to prohibit those pastors from starting a “competing” church across the street.

But, hey … that’s business.

Those churches work hard–and frequently spend enormous sums of money on direct mail campaigns, billboards, radio/tv ads, movie theater ads, and much more–to attract new attendees, and they don’t want some ex-employee trying to steal them and their weekly giving away.

If you hired a new sales manager in your car dealership, you wouldn’t want that sales manager to leave your company and start a new one directly across the street and bring along the relationships built while working in your company.

8 – Churches that succeed financially typically scale that success through planting new churches that generate additional revenue.

The dream of most church entrepreneurs/CEOs I have met is to govern more than one church campus. This may occur through having “satellite campuses” where the preacher’s sermon is live streamed into church meetings at other geographical locations.

Typically, the mother church will appoint a pastor for the new location, help with recruiting a “launch team”, and provide startup capital to rent a venue, purchase a sound system, etc.

As revenue is generated by the new church plant, that revenue remains on the balance sheet of the mother church.

Why is it hard to admit that churches are businesses?

I think there are many reasons, but I’ll share three of them here.

1 – We generally have a low view of business as a tool for social and spiritual impact, and we want to assume that our churches are above businesses on the mythical sacred-secular hierarchy.

Some church entrepreneurs/CEOs go as far as to refer to their church buildings as “the house of God”, implying that every other institution outside the church building is something less than the house of God. Of course, this is unbiblical as the New Testament makes it clear that God’s people are the house of God, His temple made without human hands.

2 – We don’t want to threaten the financial engine of charitable giving that allows churches to host gatherings on Sunday mornings by threatening its tax-exempt status or by subjecting our churches to the same consumer-driven scrutiny faced by all other small businesses in the marketplace. (But that’s where we are in the 21st century. We’ve already created a highly consumer-driven church industry.)

Church entrepreneurs/CEOs typically instruct their congregations that 100% of his/her tithe should be “paid” to his/her local church … no questions asked. On one hand, the funds are solicited as something like a tax to sustain the Sunday morning operations based on the size of one’s income; on the other hand, church entrepreneurs/CEOs appeal for funds as a generous act of charity, usually framing the appeal around a cause like disaster relief, homeless ministry, or something other than the normal operations of the church on Sunday morning (which is the only way 95% of the attendees engage with the church on a weekly basis). But all of these funds typically get commingled in the same pot.

Because there is no New Testament requirement for tithes to be paid to a local church, it is typically suggested that the Old Testament’s system of tithing to the temple applies today because the church building is said to be the modern-day temple. Again, this concept of the temple in the New Testament is unbiblical.

3 – The “business” aspects of church are hidden from most members of the congregation.

What does it cost your church for you and your family to attend on Sunday morning?

How much money and other compensation does your senior pastor make?

How much do guest preachers get paid when they come to preach at your church (and when your pastor goes to preach at that other church)?

Is your church involved in any legal disputes?

Approximately how much does your church spend on advertising?

Most of the business questions never get asked because we’d rather not think of our churches as businesses.

Bottom line: Is the organization focused on making disciples of Jesus above all else?

Whether you work in a retail store or a church … whether you attend a megachurch, a house church, or something in between … whether you’re the founder/CEO or an entry-level employee … every Christian’s and Christian-led organization’s business should be to “make disciples” of Jesus Christ.

It’s not to make profit.

It’s not to build churches.

It’s to “make disciples” of Jesus Christ.

There are many different organizational models for making disciples and “doing church”, and we must do a better job of questioning these models.

We must always question whether our organizations are truly making disciples of Jesus or if they seem to be pursuing lesser objectives as its chief aims.

As the organization (whether a church, shop, or community) inevitably deviates away from its God-given purpose to make disciples of Jesus, the Christian’s responsibility is to help reorient the organization back toward this ultimate purpose.

Discussion (please comment below)…

- Do you think the church you attend is a business? Why or why not?

- What is the per-person cost to attend your church?

1개 응답

힐송이 멸망한 후, 현대 호주에 교회가 설 자리가 있습니까?